Crypto and Leveling the Playing Field

- Karen Kuykendall

- Mar 14

- 9 min read

Updated: Mar 15

Level Playing Field: The first record of the term’s use in print comes from a January, 1977 issue of the Tyrone Daily Herald: “Our philosophy is that we have no problem competing with the mutual savings banks if they start from the level playing field,” Bolger said. [John Bolger, lobbyist for the U.S. Banker’s Association]

Crypto is big news these days. Everyone seems to be getting into it, making big money on it, and losing fortunes overnight because of it. Yet if you are like me, crypto has been a mystery for the most part, loved by some and decried by others. As the interest in it grows and the federal government talks of setting up a crypto reserve, I'd thought it was time to learn what all the fuss was about.

© Melpomenem from Getty Images via Canva.com

What Is Crypto?

Crypto currency is a form of digital or virtual currency that uses cryptography for security, making it difficult to counterfeit or double-spend. Unlike traditional currencies issued by governments, known as fiat currencies, cryptocurrencies operate on decentralized networks based on blockchain technology (explained in detail below).

In recent years, cryptocurrencies have gained popularity as investments, with many individuals and institutions entering the market. This surge in interest has led to the development of various financial products, such as cryptocurrency exchanges, wallets, and investment funds. Additionally, the concept of decentralized finance (DeFi) has emerged, allowing users to lend, borrow, and trade cryptocurrencies without traditional financial institutions.

As the technology behind cryptocurrencies continues to advance, the potential applications extend beyond just currency. Innovations such as non-fungible tokens (NFTs), which represent ownership of unique digital assets, and decentralized autonomous organizations (DAOs), which facilitate governance through smart contracts, are reshaping various industries, including art, gaming, and finance.

History of Crypto

Cryptocurrency was initially invented as a digital alternative to traditional forms of currency, emerging from the desire for a decentralized financial system that operates independently of central banks and governmental control. The concept of a digital currency started in the late 20th century, but it was not until the introduction of Bitcoin in 2009 by an anonymous entity known as Satoshi Nakamoto that it came into use.

The invention of cryptocurrency was driven by a combination of factors, including the 2008 financial crisis, which exposed the vulnerabilities and inefficiencies of the traditional banking system. Many people began to seek alternatives that offered more control over their finances, lower transaction fees, and more privacy. The decentralized nature of cryptocurrencies also meant that they were not subject to government policies at the time, making them an appealing option for those looking to protect their wealth.

Bitcoin was designed to enable peer-to-peer (P2P) internet transactions, allowing users to send and receive payments directly without the need for intermediaries such as banks. This venue was made possible through the use of blockchain technology, a distributed ledger system that records all transactions across a network of computers, thus ensuring transparency, security, and immutability. The blockchain serves as a public ledger, providing a clear and verifiable history of all transactions, which is crucial for preventing fraud and double-spending.

Since the launch of Bitcoin, the cryptocurrency landscape has expanded dramatically, with thousands of other cryptocurrencies emerging, each with unique features and uses. Some of these, like Ethereum, introduced smart contracts—self-executing contracts with the terms of the agreement directly written into code—allowing for more complex transactions and applications beyond simple currency exchange.

As cryptocurrencies gained popularity, they also attracted significant attention from investors and speculators, leading to dramatic price fluctuations and a brisk trading environment. The potential for high returns, combined with the allure of being part of a financial revolution, has drawn millions of people into the world of crypto.

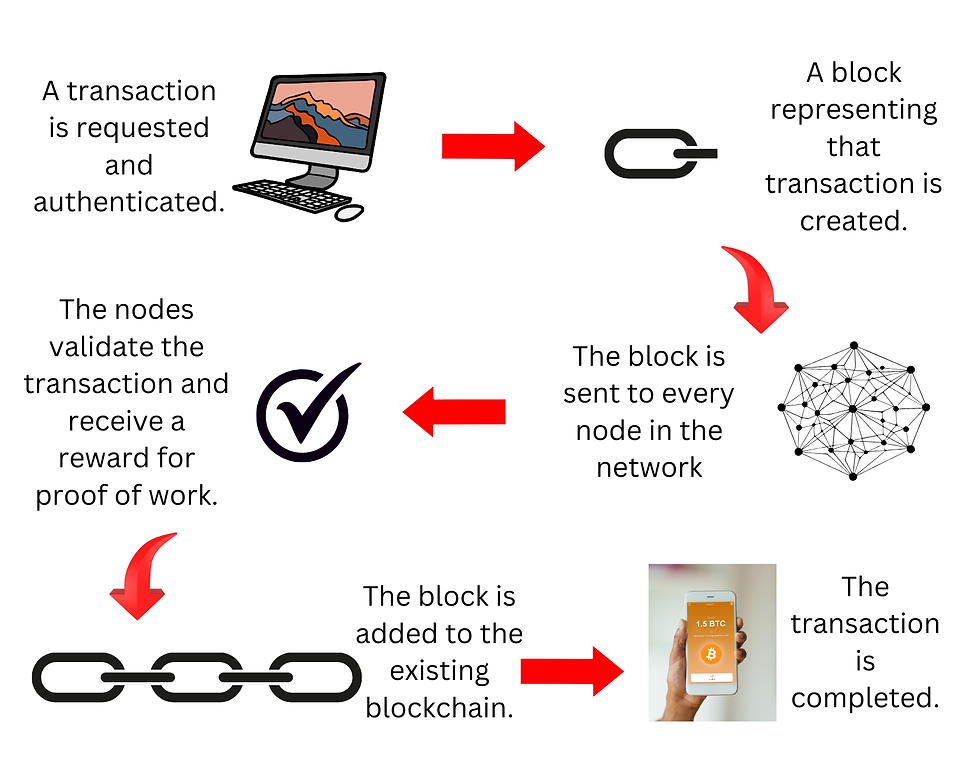

How a Crypto Transaction Works

If you have never participated in a crypto exchange, or participated while not really understanding how it works, here's the process. The transaction begins when a user decides to send a certain amount of cryptocurrency to another user. This decision often involves the use of a digital wallet, which securely stores the user's private and public keys, enabling them to interact with the blockchain network.

Once the sender initiates the transaction, they input the recipient's public address, which is a unique identifier that allows the network to recognize where the funds are intended to go. The sender also specifies the amount of cryptocurrency to be transferred. At this point, the transaction details are compiled into a digital format that includes the sender's and recipient's addresses, the amount being sent, and a timestamp to record when the transaction took place.

After the transaction details are established, the sender must sign the transaction with their private key. This cryptographic signature serves as a proof of ownership and authorization, ensuring that only the rightful owner of the funds can initiate the transfer. The signed transaction is then broadcast to the cryptocurrency network, where it enters a pool of unconfirmed transactions known as the mempool.

Within the network, individual computers called nodes hold copies of blockchains. A special kind of node called a miner or validator plays a pivotal role in confirming new transactions. They select transactions from the mempool and bundle them into a new block. The first miner to solve the problem adds the new block to the blockchain, which records all confirmed transactions in a secure and immutable manner.

Once the transaction is included in a block and the block is added to the blockchain, it becomes part of the permanent record. The recipient can then see the transaction reflected in their wallet after a certain number of confirmations, which indicates how many subsequent blocks have been added to the chain since the transaction was included. This confirmation process adds an additional layer of security, as it makes it increasingly difficult for any malicious actor to alter the transaction.

How Crypto Gets Its Value

At this point, you may be thinking, "That's all well and good, but where is the value in crypto?" When you think about it, most (if not all) monetary systems are now based on trust in and acceptance of its currency, rather than in its intrinsic value. Money of any sort relies on its perceived desirability, and the same could be said of crypto. Its value comes from people's acceptance of and willingness to use it.

The underlying technology of cryptocurrencies, particularly blockchain, plays a huge role in seeking to establish trust and security among its users. Blockchain technology seeks to ensure that transactions are transparent, immutable, and decentralized. Because the technology enables applications such as smart contracts and decentralized finance (DeFi) services as well, it seeks to increase the use of and, consequently, the value of the crypto.

Another big contributor to crypto's value is scarcity. Many cryptocurrencies, such as Bitcoin, have a capped supply, meaning there is a finite number of coins that can ever be mined. The limited supply drives up demand among investors and traders. Additionally, the halving events, which occur approximately every four years for Bitcoin, reduce the rate at which new coins are created, further tightening supply and often leading to price increases.

If more and more companies begin to accept cryptocurrencies as a form of payment, and if more individuals invest in them, the overall demand, and thus value, will increase. Institutional investment has grown in recent years, with large financial entities recognizing the potential of cryptocurrencies as an asset class, further legitimizing their value. The interest of these big investors, as well as that of governments, will definitely add to their perceived value.

Politics and Crypto

Regulatory frameworks for cryptocurrencies vary significantly from country to country.

In the US, crypto regulation is currently evolving and dependent, of course, on the administration in the White House. The Securities and Exchange Commission (SEC) determines whether certain cryptocurrencies and initial coin offerings (ICOs) should be classified as securities, and The Commodity Futures Trading Commission (CFTC) also has jurisdiction over cryptocurrencies.

In addition to these federal agencies, state regulators have also begun to establish their own frameworks for cryptocurrency regulation. Various states have implemented their own laws governing the operation of cryptocurrency exchanges, the issuance of tokens, and the licensing of businesses engaged in cryptocurrency transactions. This patchwork of state regulations can lead to confusion and compliance challenges for companies operating in multiple jurisdictions.

The regulatory environment is also influenced by ongoing discussions in Congress regarding potential legislative measures aimed at creating a more cohesive national policy. Lawmakers are grappling with how to balance the need for consumer protection and financial stability with the desire to foster innovation within the burgeoning cryptocurrency sector. The debate often centers around issues such as anti-money laundering (AML) and know your customer (KYC) requirements, taxation of cryptocurrency transactions, and the environmental impact of cryptocurrency mining.

In the last few election cycles, crypto companies have jumped into politics with their own donations and agendas. According to an article by CNBC, the 2024 election saw the greatest activity so far:

(Brian) Armstrong, whose company helped the crypto sector raise and direct $250 million into the 2024 election cycle, outpacing Wall Street banks and the oil industry, has been instrumental in shaping the new administration’s approach to digital assets. Crypto’s push to unseat opposition lawmakers and install pro-crypto candidates paid off handsomely, flipping key seats and cementing the sector as a major political force in Washington.

With that kind of money in play, it is easy to see how the controllers of crypto could heavily influence the amount of regulation the industry will have in the future. The crucial factor, of course, is how and how much crypto can harm or help, especially the vulnerable among us.

Advantages and Pitfalls

Crypto appears to offer certain advantages over traditional financial systems, such as giving users greater control over their funds through direct transactions. Crypto can also be accessed by anyone with an internet connection, making it a potential solution for the unbanked populations around the world.

Crypto has been touted as a positive alternative for people without a bank account, presenting itself as a solution that would empower individuals who have historically been excluded from the traditional banking system. Millions of people around the world lack access to basic financial services, often due to geographical, economic, or social barriers. Cryptocurrency, with its decentralized nature, offers an alternative that could bypass the limitations and safeguards imposed by conventional banks.

But is crypto really a route toward economic mutuality? The potential is certainly there, but the pitfalls are as well. The market is highly volatile, with prices often experiencing dramatic fluctuations in short periods. This volatility can be attributed to various factors, including market speculation, regulatory news, and technological developments. Here is the conclusion from a 2022 report by the Brookings Institute about how crypto can affect the financially vulnerable:

Given the technology’s risks, drawbacks, and overall limitations, we can think about cryptocurrencies as part of the legacy of “predatory inclusion.” Sociologists and other scholars, including Keeanga-Yamahtta Taylor, Louise Seamster, Raphaël Charron-Chénier, and Tressie McMillan Cottom, have examined the concept of predatory inclusion extensively in other areas. It refers to marginalized communities gaining access to goods, services, or opportunities that they were historically excluded from—but this access comes with conditions that undermine its long-term benefits and may reproduce insecurity for these same communities. Payday loans are an example, as they provide access to credit but come with high costs and risks. Subprime mortgages, which provide access to homeownership but come with high risks, are another. Similarly, crypto may offer access to financial services (according to the industry’s narratives), but with the caveats of high risks and insufficient consumer protections.

Similar to how proponents depict cryptocurrencies as a way to “democratize finance,” payday loans were once described as a way to promote the “democratization” of credit. Subprime mortgages were also heralded as “innovations” that would open doors for excluded communities, but ultimately decimated the wealth of Black and Latino or Hispanic communities during the 2008 financial crisis and its aftermath.

Last, but perhaps the topic that should be top of mind, the anonymity that cryptocurrencies can provide has raised concerns regarding their use in facilitating illegal activities, such as drug and human trafficking, tax avoidance, money laundering for terrorism, and more.

Conclusion

While crypto presents opportunities for financial creativity, it poses risks and challenges. Once again, the answer lies in thoughtful consideration and careful regulation, taking the time to consider the end results and not just the short term gains. A level playing field requires playing the long game.

Not sure? Let's schedule a call and talk.

⭐⭐⭐⭐⭐ Our Amazon number 1 new release: Unleash more with Better Capitalism: Jesus, Adam Smith, Ayn Rand, & MLK Jr. on Moving from Plantation to Partnership Economics.

"This book merits close, sustained attention as a compelling move beyond both careless thinking and easy ideology."—Walter Brueggemann, Columbia Theological Seminary

"Better Capitalism is a sincere search for a better world."—Cato Institute

Comments